Category: Building & Real Estate

Apr 28

Friday Live Chat – nextSTL

Apr 26

Loop Trolley Corridor Photo Tour: DeBaliviere

As the Loop Trolley project nears completion let’s look at the changes to the streetscape and the condition and potential of the adjacent land. A goal of the trolley is to encourage development along the route. Neighborhood and TOD plans for the area express a desire to build urbanity. Beyond creating a great walkable neighborhood, more productive land uses are imperative to cover the cost of infrastructure and services in the long term. Public investment should follow private investments so as to minimize the public’s risk. Parts of the trolley route are quite productive, so the route may have a good combination of supporting productive places and “built ti and they will come.”

The trolley operates on a single track from the Missouri History Museum up DeBaliviere alongside the St. Vincent Greenway then heads west at Delmar.

The Missouri History Museum stop. The trolley won’t go this far when the museum is closed. Perhaps a shelter could be an incremental improvement later.

The Missouri History Museum stop. The trolley won’t go this far when the museum is closed. Perhaps a shelter could be an incremental improvement later.

Heading north along DeBaliviere.

Heading north along DeBaliviere.

At Lindell Blvd. Pedestrian infrastructure has improved, though there are drainage problems on the northeast corner. I would love pedestrian refuges in Lindell. Because DeBaliviere is divided here, there is room since there are no turn lanes in the crosswalks. They would help slow cars and aid crossing Lindel.

At Lindell Blvd. Pedestrian infrastructure has improved, though there are drainage problems on the northeast corner. I would love pedestrian refuges in Lindell. Because DeBaliviere is divided here, there is room since there are no turn lanes in the crosswalks. They would help slow cars and aid crossing Lindel.

The land along DeBaliviere between Lindell and Forest Park Parkway is a part of Forest Park. Inactive grass for many years, it is now getting a landscaping overhaul.

The land along DeBaliviere between Lindell and Forest Park Parkway is a part of Forest Park. Inactive grass for many years, it is now getting a landscaping overhaul.

At Forest Park Parkway. The intersection was completely rebuilt. Pedestrian infrastructure has greatly improved.

At Forest Park Parkway. The intersection was completely rebuilt. Pedestrian infrastructure has greatly improved.

There’s a development opportunity at the 1.5 acre Metrolink parking lot. Bi-State provides 118 government-subsidized parking spaces. The tax exempt land use generates no revenue for the SLPS, the city, ZMD, MSD, etc. Let’s hope it joins the tax rolls sometime soon.

There’s a development opportunity at the 1.5 acre Metrolink parking lot. Bi-State provides 118 government-subsidized parking spaces. The tax exempt land use generates no revenue for the SLPS, the city, ZMD, MSD, etc. Let’s hope it joins the tax rolls sometime soon.

Vision for Forest Park Parkway and DeBaliviere. H3 Studio

Vision for Forest Park Parkway and DeBaliviere. H3 Studio

Another development opportunity across the street on another tax-exempt Bi-State-owned lot. It kept its curb cut.

Another development opportunity across the street on another tax-exempt Bi-State-owned lot. It kept its curb cut.

Trolley stop at Pershing. It is shared with the 90 Hampton and 3 Forest Park Trolley buses. Annoying that it’s not closer to the Metrolink station.

Trolley stop at Pershing. It is shared with the 90 Hampton and 3 Forest Park Trolley buses. Annoying that it’s not closer to the Metrolink station.

The traditional building at DeBaliviere and Pershing has an assessed value per acre of $833k.

The traditional building at DeBaliviere and Pershing has an assessed value per acre of $833k.

The intersection of DeBaliviere and Pershing. Three sides of the intersection are greatly improved.

The intersection of DeBaliviere and Pershing. Three sides of the intersection are greatly improved.

A crosswalk on the north side is missing. I complained about this to the Trolley Company last year when it became apparent it was missing. The engineer said that the reason it wasn’t put in was that the vast majority of the foot traffic is north-south (a non-sequitur IMO), and that it was too difficult to put an ADA compliant crosswalk there. I suspect no one seeking to cross there will go 3/4 around the intersection as we see at the missing crosswalk at Euclid and Forest Park Avenue. Ignoring reality is regrettable.

A crosswalk on the north side is missing. I complained about this to the Trolley Company last year when it became apparent it was missing. The engineer said that the reason it wasn’t put in was that the vast majority of the foot traffic is north-south (a non-sequitur IMO), and that it was too difficult to put an ADA compliant crosswalk there. I suspect no one seeking to cross there will go 3/4 around the intersection as we see at the missing crosswalk at Euclid and Forest Park Avenue. Ignoring reality is regrettable.

Redevelopment opportunity on DeBaliviere between Pershing and Waterman. Unfortunately the traditional buildings here were demolished in the 1980s for this low-productivity auto-oriented land use. It’s assessed value per acre is $249K. I suspect it’s not covering its burden on city services.

Redevelopment opportunity on DeBaliviere between Pershing and Waterman. Unfortunately the traditional buildings here were demolished in the 1980s for this low-productivity auto-oriented land use. It’s assessed value per acre is $249K. I suspect it’s not covering its burden on city services.

Vision for the strip mall redevelopment looking southwest from Waterman and DeBaliviere. H3 Studio

Vision for the strip mall redevelopment looking southwest from Waterman and DeBaliviere. H3 Studio

Street Parking was added on the west side of DeBaliviere.

Street Parking was added on the west side of DeBaliviere.

Redevelopment opportunity across the street. This low-productivity auto-oriented land use has an assessed value per acre of $239k.

Redevelopment opportunity across the street. This low-productivity auto-oriented land use has an assessed value per acre of $239k.

It and the property next door get to keep their curb cuts. Quite an amenity for such low return.

It and the property next door get to keep their curb cuts. Quite an amenity for such low return. They could have shared one or used alley access as they did when construction blocked access from DeBaliviere- somehow auto-dependent patrons found their way.

They could have shared one or used alley access as they did when construction blocked access from DeBaliviere- somehow auto-dependent patrons found their way.

The intersection of Waterman and DeBaliviere looking southeast.

The intersection of Waterman and DeBaliviere looking southeast. The intersection of Waterman and DeBaliviere looking northwest.

The intersection of Waterman and DeBaliviere looking northwest. The curb cut at the southwest corner is awkward for north-south travelers.

The curb cut at the southwest corner is awkward for north-south travelers. {#Healthegrid}

{#Healthegrid}

This was a missed opportunity to heal the grid, relieving traffic pressure on Pershing and providing quicker access for EMS.

Development opportunity on the absurdly large Busey Bank parking lot. Unfortunately the traditional building at 433 DeBaliviere succumbed to fire in 1970.

Development opportunity on the absurdly large Busey Bank parking lot. Unfortunately the traditional building at 433 DeBaliviere succumbed to fire in 1970. 400 block of DeBaliviere. What was best exemplifies what should be.

400 block of DeBaliviere. What was best exemplifies what should be.

Some parts of the east side of DeBaliviere have a highway feel due to lack of street parking, wide lanes, low-rise land uses, and the grassy strip running next to it. The trees may help as they grow.

Some parts of the east side of DeBaliviere have a highway feel due to lack of street parking, wide lanes, low-rise land uses, and the grassy strip running next to it. The trees may help as they grow.

McPherson blocked at DeBaliviere

McPherson blocked at DeBaliviere

Kingsbury blocked at DeBaliviere

Kingsbury blocked at DeBaliviere

Development opportunity across from Crossroads School. The school owns the parcel, and it is tax-exempt. Hopefully it will join the tax rolls soon.

Development opportunity across from Crossroads School. The school owns the parcel, and it is tax-exempt. Hopefully it will join the tax rolls soon.

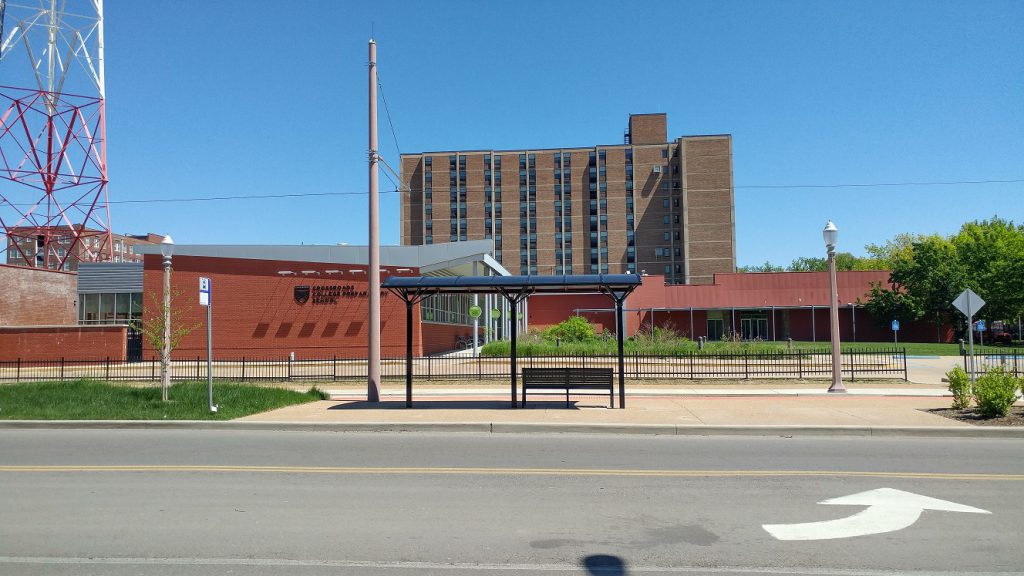

Crossroads School got to keep both its curb cuts and has a trolley stop, tax-exempt.

Crossroads School got to keep both its curb cuts and has a trolley stop, tax-exempt.

Left – This sad-sack building, owned by someone in Frontenac living in a $1,345,000 home, could use some love. Right – A small church, tax-exempt.

Left – This sad-sack building, owned by someone in Frontenac living in a $1,345,000 home, could use some love. Right – A small church, tax-exempt.

KMJM 100.3 transmission tower. Any chance it could move?

KMJM 100.3 transmission tower. Any chance it could move?

Cute fire station No. 30, city-owned and tax-exempt of course.

Cute fire station No. 30, city-owned and tax-exempt of course.

Tax-exempt car storage with three-lane curb cut for Crossroads School.

Tax-exempt car storage with three-lane curb cut for Crossroads School.

The behemoth Metro garage- tax-exempt.

The behemoth Metro garage- tax-exempt.

{H3 Studio}

{H3 Studio}

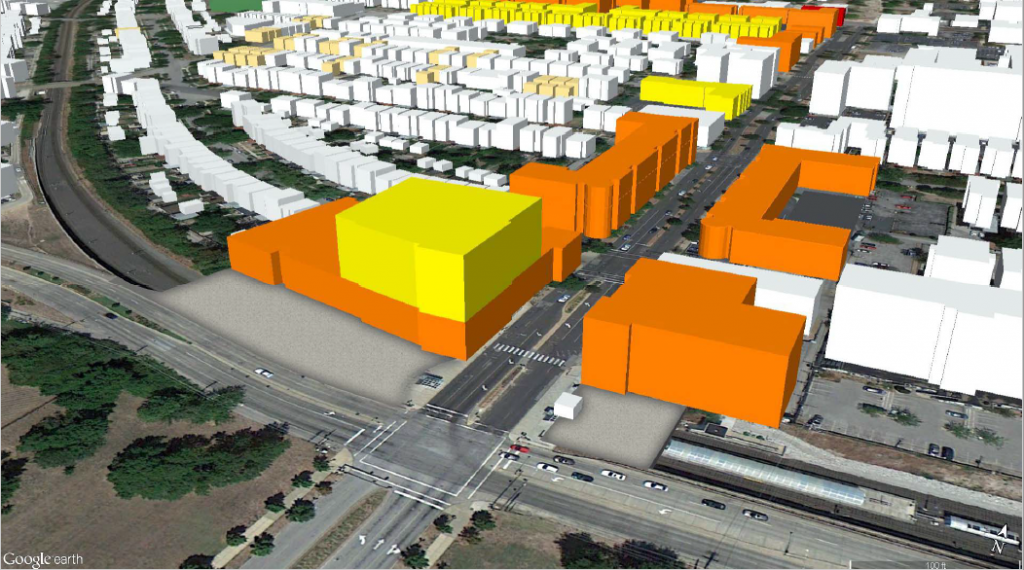

The Skinker DeBaliviere neighborhood plan shows the possibility of the garage being vacated and available to be developed.

DeBaliviere at Delmar is adorned with two really cool buildings and has a trolley stop.

DeBaliviere at Delmar is adorned with two really cool buildings and has a trolley stop.

566 DeBaliviere. Numerous pictures at St. Louis Patina.

566 DeBaliviere. Numerous pictures at St. Louis Patina.

Across the street. My dream for this is a micro-brewery. There’s space for the outdoor biergarten already.

Across the street. My dream for this is a micro-brewery. There’s space for the outdoor biergarten already.

Social Security office- tax-exempt.

Social Security office- tax-exempt.

Ruth Porter Park with the St. Vincent Greenway extends north. I wonder if it would have been better to extend DeBaliviere north.

Ruth Porter Park with the St. Vincent Greenway extends north. I wonder if it would have been better to extend DeBaliviere north.

Another crosswalk is missing on the west side of DeBaliviere at Delmar.

Another crosswalk is missing on the west side of DeBaliviere at Delmar.

The new Adolescent Behavioral Health Center by People’s Health.

The new Adolescent Behavioral Health Center by People’s Health.

The remake of DeBaliviere with the Loop Trolley and St. Vincent Greenway has greatly improved it. Four driving lanes were too many, and the street diet is welcome. Regrettably only one of the eight private curb cuts crossing the trolley’s path has been removed- a nod to the continued auto-orientation of the corridor. Three public street blockages were maintained. On-street parking has been added on parts of the west side of DeBaliviere. Some parts of DeBaliviere and the greenway have a highway feel.

The remake of DeBaliviere with the Loop Trolley and St. Vincent Greenway has greatly improved it. Four driving lanes were too many, and the street diet is welcome. Regrettably only one of the eight private curb cuts crossing the trolley’s path has been removed- a nod to the continued auto-orientation of the corridor. Three public street blockages were maintained. On-street parking has been added on parts of the west side of DeBaliviere. Some parts of DeBaliviere and the greenway have a highway feel.

{Massing of DeBaliviere from TOD plan. H3 Studio}

{Massing of DeBaliviere from TOD plan. H3 Studio}

With so much tax-exempt and low-productivity land uses along DeBaliviere, this part of the route isn’t pulling its weight. Let’s hope more productive land uses will come soon.

Apr 25

City’s Preservation Board Greenlights Smart Infill, Deny’s Needless Demo

Yesterday, the City of St. Louis Preservation Board had a good day. The decisions of that board, informed by recommendations from the city’s Cultural Resources Office, are generally quite straightforward, mostly unexciting. There are a lot of denials of generic Home Depot doors in Local Historic Districts, and things of that sort.

The board’s role is constrained. It can’t require better urbanism, but absent a city-wide housing and development policy, the Preservation Board takes on part of the city-building role. The board takes public testimony, is presented plans by developers, and adjudicates the future of a building or development, and in this way, our city.

So what did the Preservation Board do yesterday? It gave preliminary approval to the big infill project at the long-vacant Praxair site in Lafayette Square. A first hearing was greeting largely by people in opposition. This time, neighborhood residents in favor of the plan spoke up.

The approval comes with some caveats, that the townhomes be fully wrapped in a brick veneer, that sidewalks be added to LaSalle Street as it extends into the development, and that units facing Chouteau Avenue be re-presented with design changes. Such caveats are quite common in board decisions.

The townhomes by Pulte Homes and Killeen Studio Architects aren’t perfect. Better design is hampered by the Local Historic District, for better or worse. For an industrial site on the edge of the Lafayette Square neighborhood, more should have been allowed by code. The focus should have been better urbanism and less an aesthetic pursuit. Such is the changing nature of urban historic preservation.

Assuming the project moves forward, it represents what more-fancy urban planners call “gentle density” or “density done well”. In St. Louis too many people think of it as scary density. That vacant industrial lot that exploded a decade ago? It didn’t create any traffic, no noise…you get the idea.But townhome development is very significantly more sustainable, produces a much greater return to the city, than single-family homes.

But townhome development is very significantly more sustainable, produces a much greater return to the city, than single-family homes, even the big historic ones in Lafayette Square. It’s a balancing act to be sure, but when and where townhomes can be developed in a thoughtful, urban manner, the city (and residents) should offer support.

Read more: Changes Present Better Urban Design for Lafayette Square Praxair Site

____________________________

What else did the board do? It denied a request by the Missouri Foundation for Health. Its mission reads, “to improve the health and well-being of individuals and communities most in need.” It hired architectural behemoth HOK to repurposed the Columbia Iron Works site in Forest Park Southeast.

MFA requested approval to demolish a residential building at 1408-1410 Tower Grove Avenue. The structure is a merit building in a National Register district and found to be in sound condition. The demolition would have made way for a “secure employee courtyard”. It’s unclear how removing a four-unit affordable apartment building in a quickly changing central neighborhood improves the health and well-being of individuals and communities most in need.”

Even with HOK’s inventive euphemistic “flexible community zone” to label a parking lot, the project failed to win the support of the Park Central Development Corporation’s development committee. Despite this, the Cultural Resources Office surprisingly endorsed the demolition, with some creative reasoning: “The proposal by the Missouri Foundation for Health to rehabilitate the Columbia Iron Works Facility exceeds the value of the preservation of the four-family structure, which is incompatible with the proposed development for the Foundation.”

Having read Preservation Board agendas for more than a decade, I’ve never seen such reasoning, which I read as giving the go-ahead for demolition to any developer wanting to develop a different use for a sound merit building in National Register District. Basically, the justification is simply that the developer doesn’t want the building. It’s that silly.

Still, with the board could have simply endorsed the CRO recommendation over the objection of the neighborhood development corporation. Often times the ward alderman will weigh in publicly, or quietly on such issues. It’s unclear whether the Roddy campaign sign at 1408-1410 Tower Grove represents an endorsement for demo or a plea for help.

Read more: Missouri Foundation for Health Plans New Home at Columbia Iron Works in The Grove

____________________________

Bonus smart decision – the Preservation Board gave preliminary approval to the HOK-designed apartment building for the South Grand Y site:

Read more: Contemporary 116-Unit Apartment Building Planned for South Grand YMCA Site

Apr 21

Friday Live Chat

It’s back, the Friday Live Chat. You know what to do – just use the comments section below. We’re in…

Apr 20

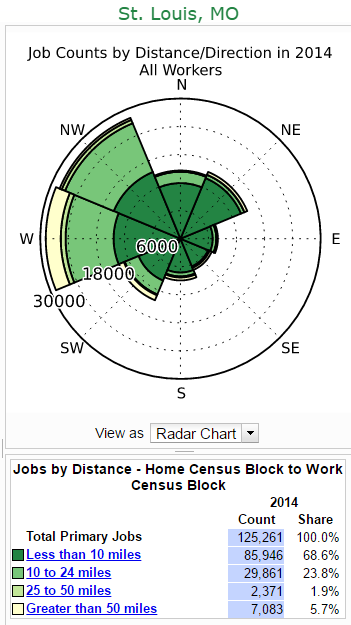

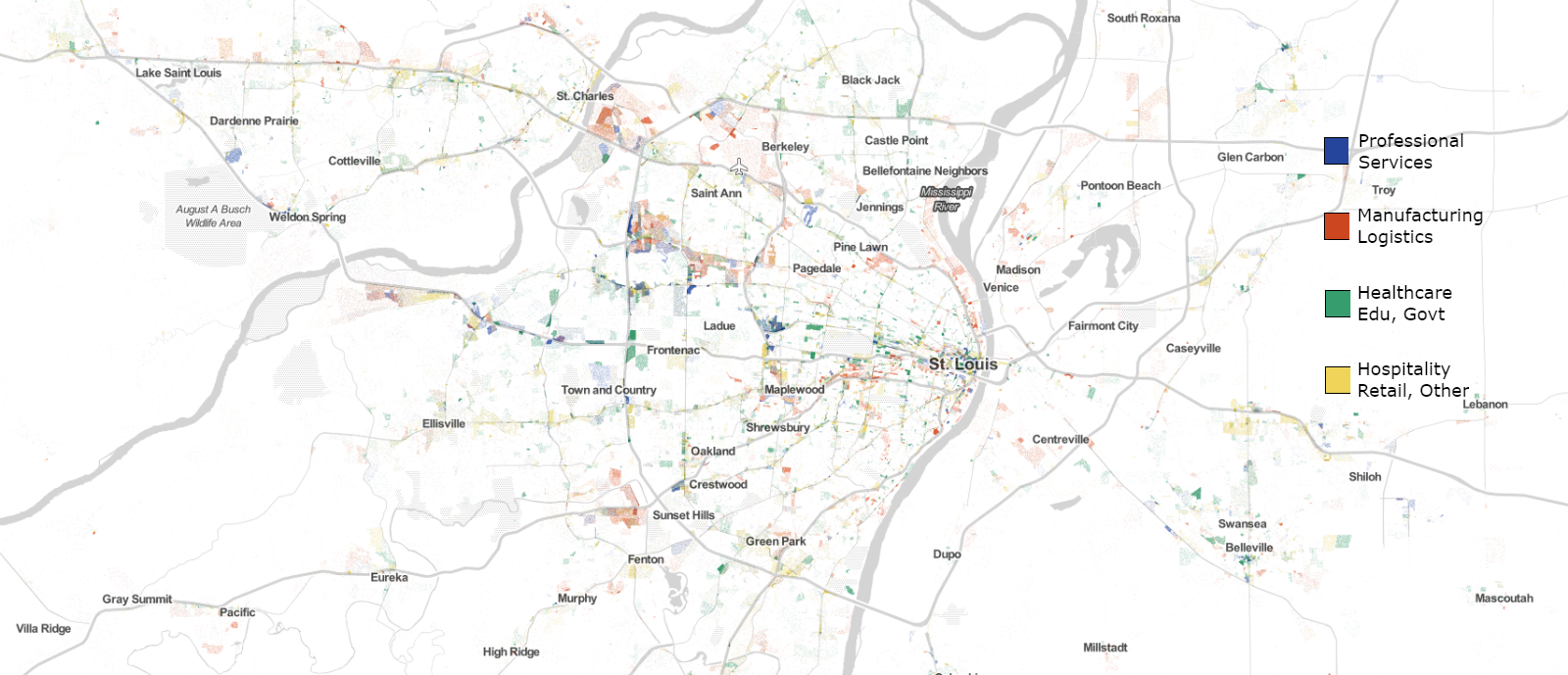

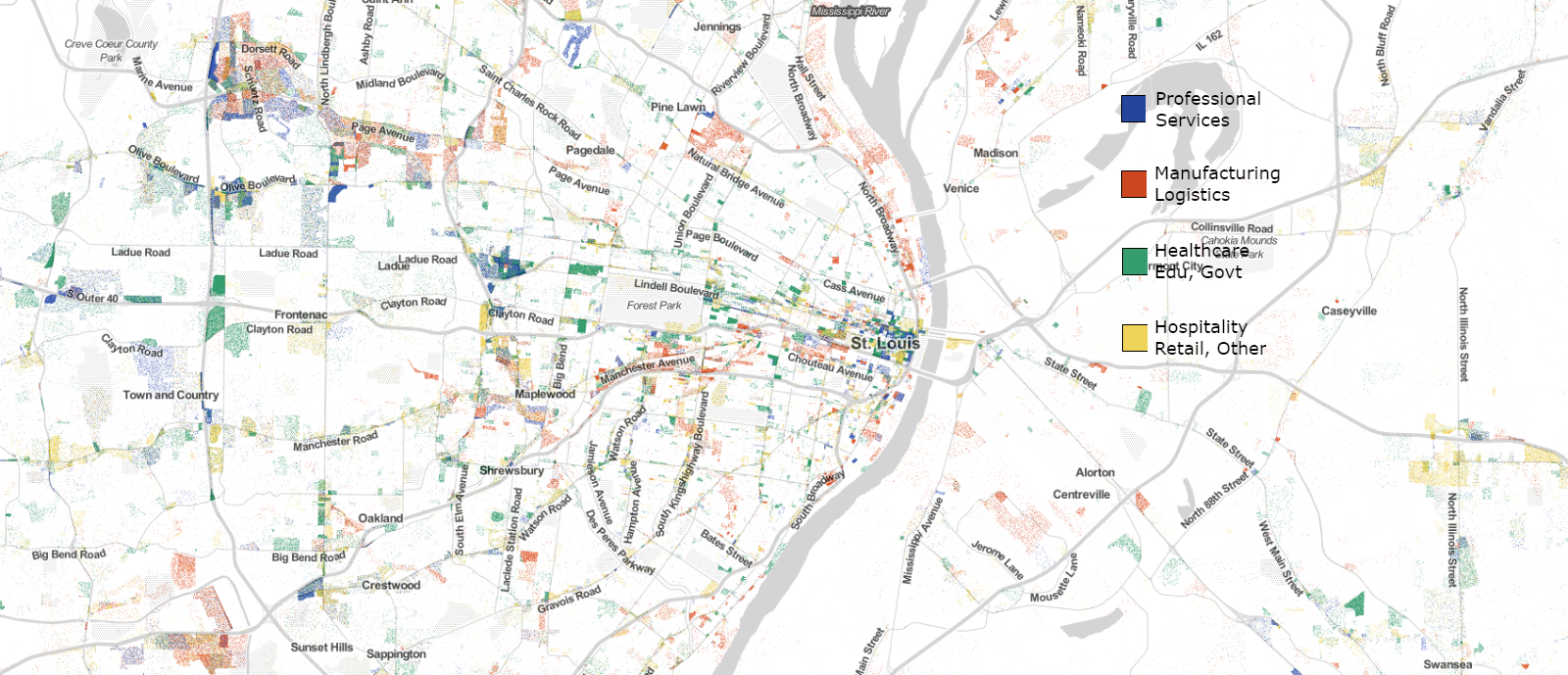

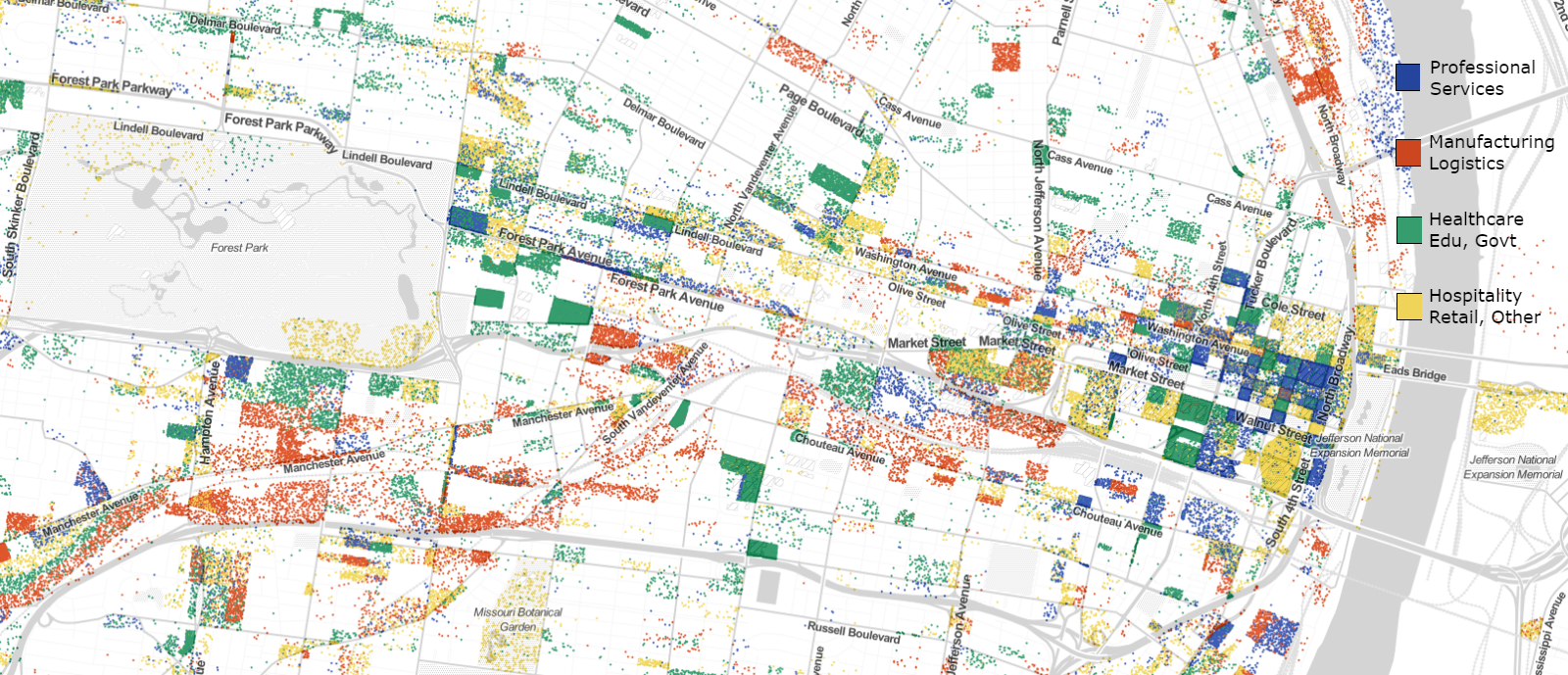

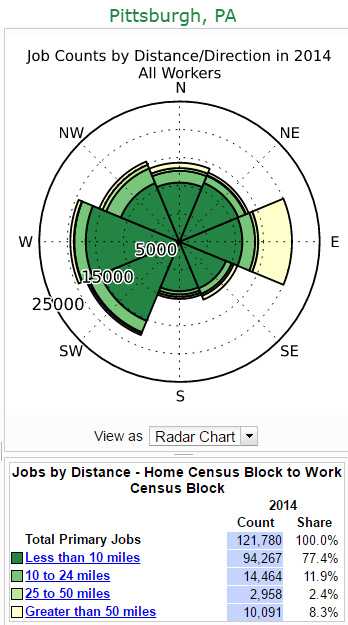

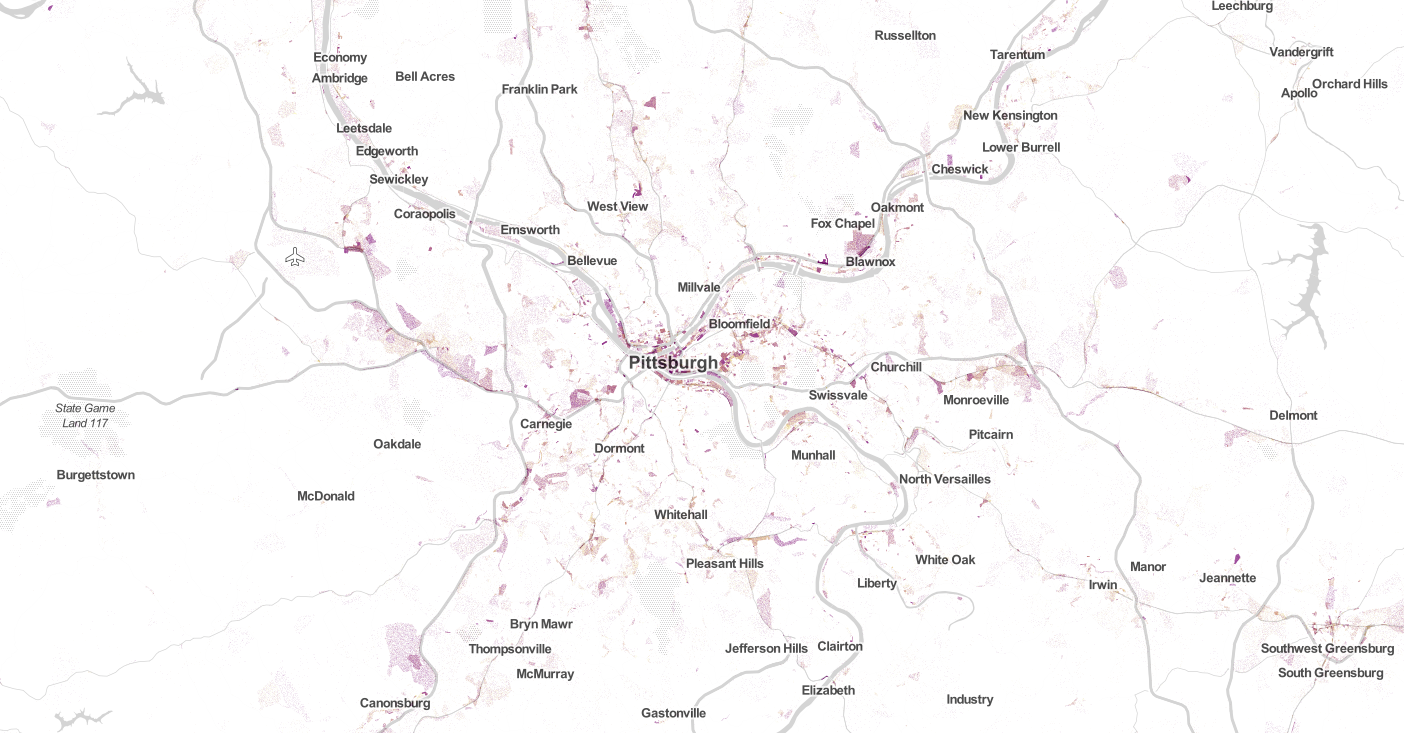

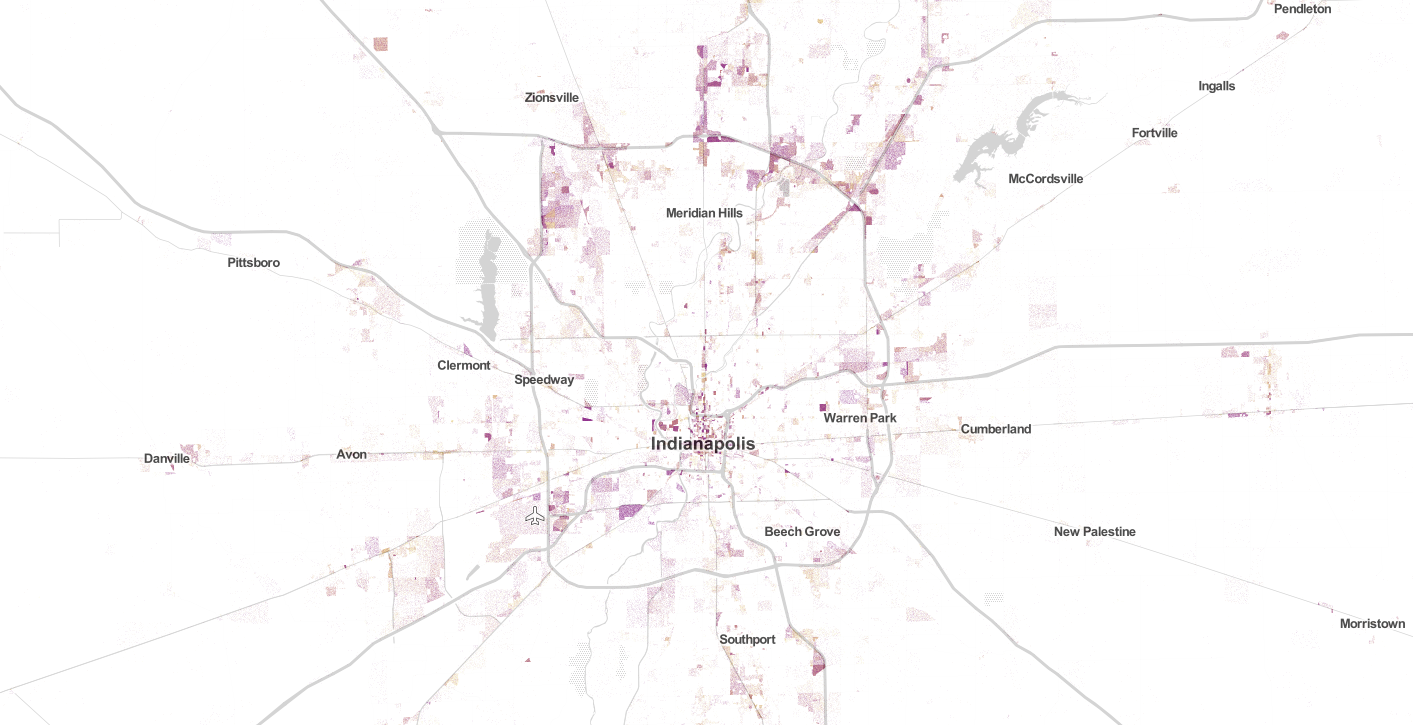

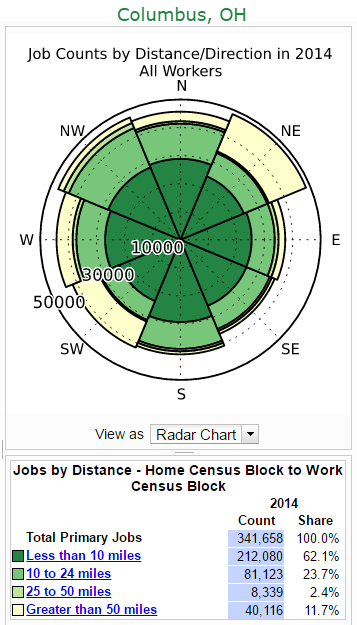

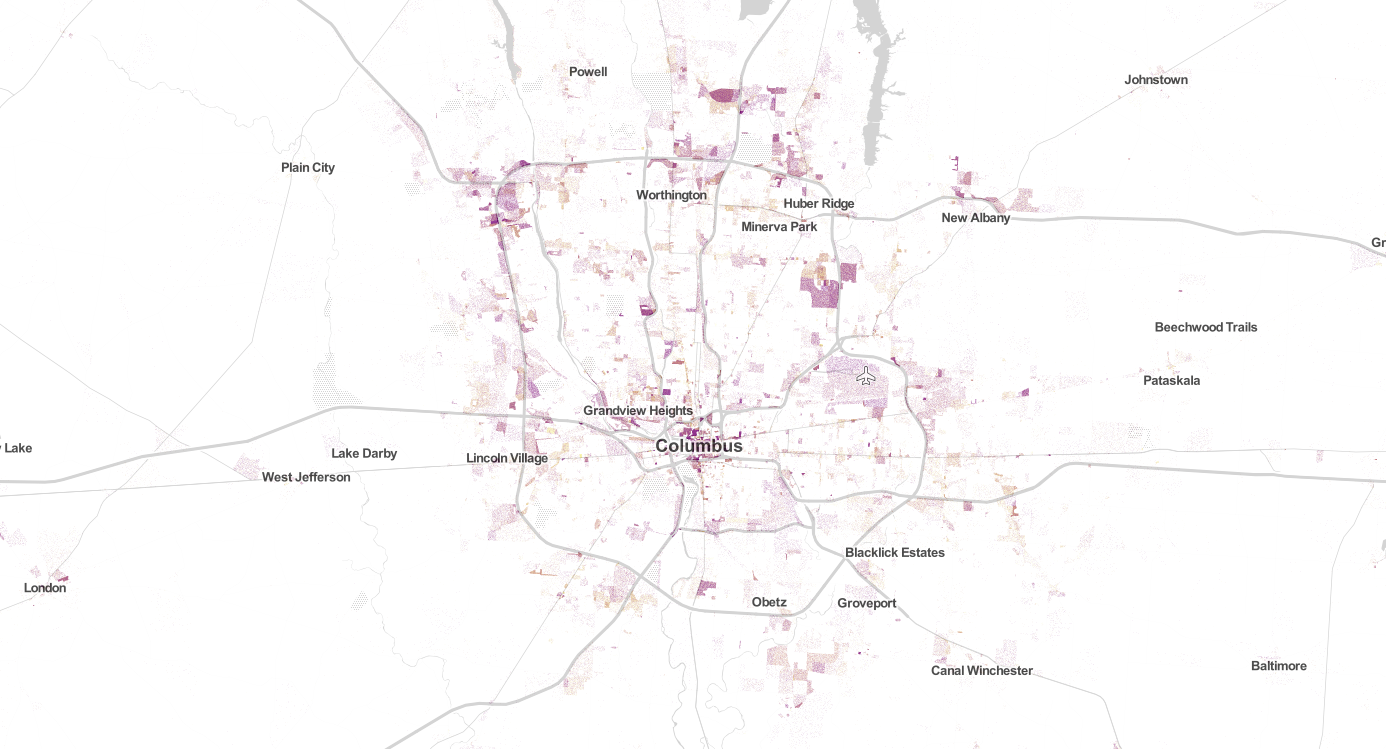

Understanding St. Louis: Asymmetry of Job Counts by Distance/Direction

Downtown St. Louis is the center of the region. Sort of. Downtowns, despite their long-waning position as anchor employment and shopping districts, continue to serve as a sort of ceremonial “center” in most metro regions.

Downtown St. Louis is the center of the region. Sort of. Downtowns, despite their long-waning position as anchor employment and shopping districts, continue to serve as a sort of ceremonial “center” in most metro regions.

Downtown is generally where City Hall can be found, as well as the tallest buildings, often the sports arenas, the courts, some convergence of transit, etc. Downtown is where a region celebrates. It’s where you find championship parades, conventions, the largest civic events, the marathons, festivals, that Arch, and more.

But downtown St. Louis is far from the actual center of the region. Our population center lies somewhere between Olive Boulevard and I-64 along I-270. While the combined population of St. Louis City, St. Louis County, and St. Charles County has grown just 1.6% since 1970, the population center of the region has fled west.

At the same time, the Metro East has continued to lose jobs and residents. From 2000-2010, the Illinois counties of the Metro East lost a greater percentage of their population than did the City of St. Louis (8%).

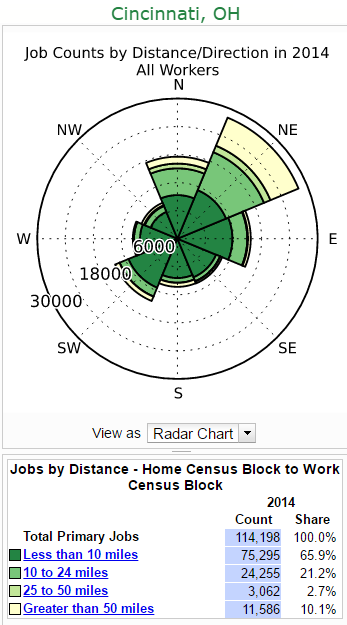

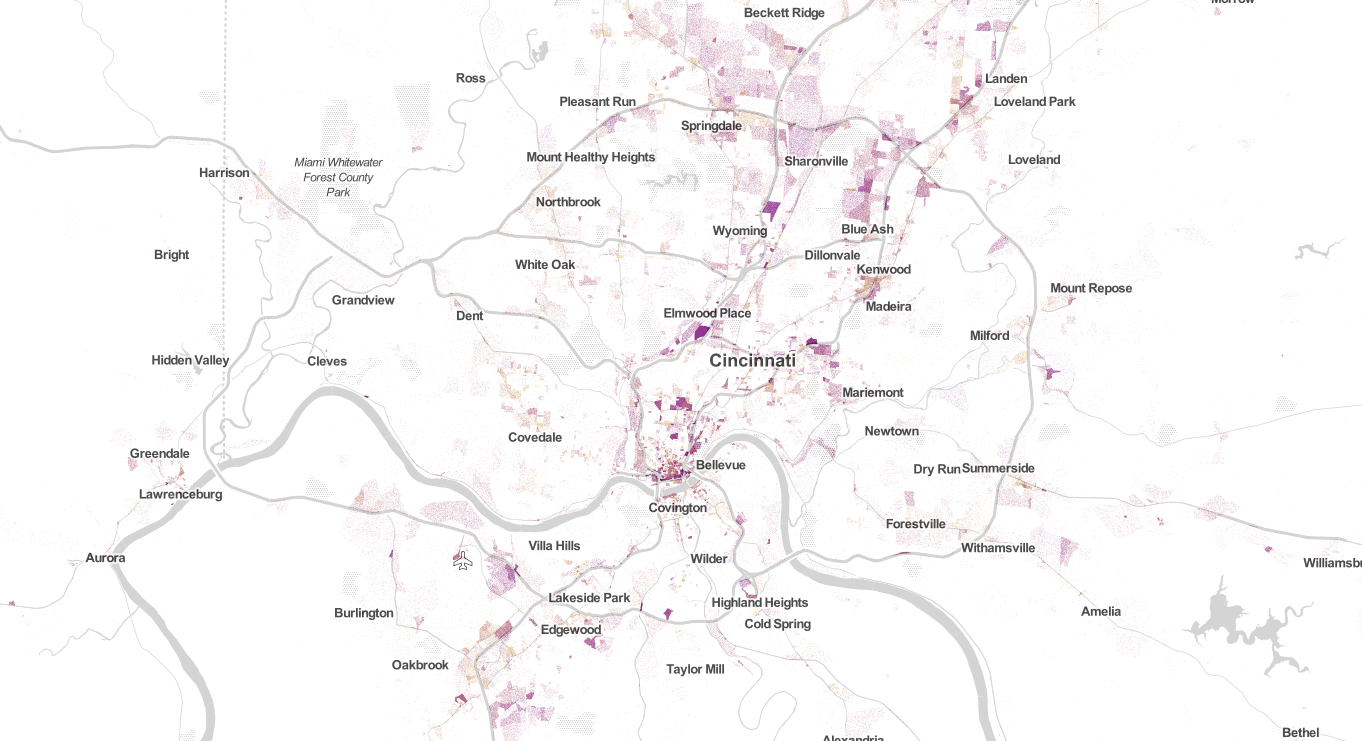

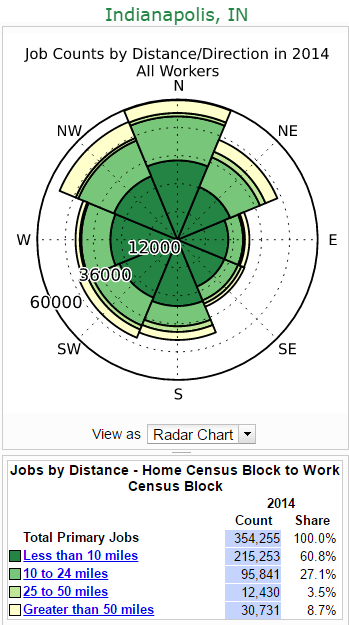

And while downtowns across the Midwest have lost employment and retail density, St. Louis may be unique in how displaced our downtown has become from jobs, retail, and residents. Looking at the cities of Columbus, Indianapolis, Pittsburgh, Cincinnati, and St. Louis highlights the difference.

Both Columbus and Indianapolis show significantly greater job sprawl than St. Louis, but their downtowns have remained very nearly the center of their respective regions. Pittsburgh is significantly more compact and centered. Cincinnati is heavily skewed but shows greater balance, and its asymmetry is created in part because of development along the I-75 corridor to nearby Dayton.

So what? Well, we can imagine downtown St. Louis as the center of the region but must recognize that it is not. How we understand this should inform policy and planning decisions regarding transit, retail, development subsidies and more. That is, you simply can’t create development strategy without recognizing the unique position of downtown St. Louis.

By income:

Employment dot maps: http://www.robertmanduca.com/projects/jobs.html

Jobs distance and direction radar maps: https://lehd.ces.census.gov/

Apr 18

An Assessment of the Effectiveness and Fiscal Impacts of the Use of Development Incentives in the St. Louis Region

Executive Summary

In the last 20 years local governments in the metropolitan St. Louis region have diverted more than $5.8 billion in public tax dollars to subsidize private development through the use of various financial incentives, including tax increment financing, special taxing districts and tax abatements. Municipalities, counties and states used these development incentives in the competition to lure tax-generating businesses to their specific jurisdiction. These incentives subsidized new developments by taking a portion of what otherwise would have been paid as taxes and instead diverting them to the private developer to finance the development.

In response to concerns about the long-term effects on the economic health of the region and the fiscal well being of local governments, the East-West Gateway Board of Directors (made up of the region’s local elected officials) took the following action:

…authorize the staff to undertake a study of the effectiveness of local development incentives to help determine potential actions by the Board. The study should include an inventory of the amount of previous incentives granted by local government and the resulting economic activity from the projects financed through incentives. The study should also determine the effect of local development incentives on the ability of local governments to finance essential public services and the degree to which the extensive use of incentives contributes to economic and racial disparities in the region.

This research documents that the use of these tax incentives has been ineffective both as a way to increase regional sales tax revenue or to produce a significant increase in quality jobs. It also clearly has not helped municipalities avoid fiscal stress or had a general beneficial economic impact on the region.

Over the same period, the region has made modest employment gains, primarily in the service sector. Job growth overall has been sluggish, growing at a rate of about 0.8% annually from 1990 to 2007, with a significant slowdown after the year 2000, when the growth rate fell to 0.2%. Retail employment is of particular interest because, according to East-West Gateway estimates, about 80% of tax increment financing (TIF) and transit development district (TDD) incentives have been for retail oriented development. From 1990 to 2007, retail sector employment grew from about 142,100 jobs to 147,500, a gain of about 5,400 jobs. Since 2007, during the recession, both sales tax revenues and job growth have decreased significantly, as might have been expected.

In addition to the $2.5 billion documented in East-West Gateway’s Interim Report, this Final Report provides estimates of the additional tax revenue forgone through tax abatement programs in both states as well as tax revenue allocated to private development in the region through the use of state tax incentive programs. This report refines some of the data used in the Interim Report for TIF and special taxing districts, and includes more recent data, through 2009.

There are examples of the effective use of development incentives but they are greatly outnumbered by the projects that produce localized benefits at a high cost with little or no demonstrable economic benefit. The problem is not the use of incentives, but how they are used. The purpose of this report is to challenge community leaders, both in the public and private sectors, to reconsider the role of local development incentives as part of a comprehensive regional economic development strategy and to provide the necessary information to develop policy and legislative changes that might produce real and sustainable economic growth for the St. Louis region.

This Final Report includes research by East-West Gateway staff and research commissioned from area universities, and contains the following elements:

- An inventory of the use of development incentives in the St. Louis region

- An account of the local and regional effects of those tax incentives

- An assessment of the local government finances

- Conclusions and legislative recommendations

Based on the findings of this research, we have reached the following conclusions:

1. There has been a massive public subsidy of private development – more than $5.8 billion – in the last 20 years across the St. Louis region. The $5.8 billion diversion of public tax dollars to private developers is a conservative conclusion based upon the best available data. About half of this has been allocated through two types of programs that are predominantly used for retail development: tax increment financing (more than $2 billion) and special taxing districts (more than $500 million).

2. Evidence exists that the use of TIF and other tax incentives, while positive for the incentive using municipality, has negative impacts on neighboring municipalities. An examination of sales tax revenues and the use of TIF demonstrate that declining shares of sales tax revenue in one municipality often coincides with the use of incentives and growth of tax revenue share in neighboring municipalities. Zip codes that have TIF-related investment have been found to have an increase of jobs in the active TIF years, but that TIF use was associated with a decrease in jobs elsewhere.

3. Local governments in the region are under fiscal stress. A significant number of municipalities have experienced declining sales and/or property tax revenues, particularly when these revenues are adjusted for inflation. A significant number of municipalities faced budget deficits, layoffs and service cuts between 2000 and 2007, even though that was a period of time when the economy had generally fared well. In a survey of municipal officials, many indicated they had serious concerns about the long-term fiscal sustainability of their cities.

4. The use of tax incentives has exacerbated economic and racial disparity in the St. Louis region. Historically, tax incentives to private developers are less often used in economically disadvantaged areas and their more frequent use in higher-income communities gives those jurisdictions what amounts to an unneeded, extra advantage. Tax incentive tools such as v Chapter 99 and Chapter 353 tax abatements and TIFs were used repeatedly in the central business district and the west end of the city of St. Louis while they were used sparingly in depressed sections of North St. Louis. Throughout the region, areas of concentrated poverty begin at a distinct disadvantage when trying to compete for customers, businesses and jobs and are further handicapped when higher-income communities receive additional advantages through diversion of tax dollars to private developers via tax incentives.

5. A complete database of Missouri municipal finances is needed. The Illinois Comptroller has an electronic database of all taxing districts. In Missouri, such a system should be developed to help local officials to make informed decisions, and to provide transparency and accountability. The current system in Missouri involves municipalities filing hard-copy reports with the State Auditor Office.

6. Across all incentive programs, the provisions for uniform reporting of revenues, expenditures, and outcomes (jobs, personal income, increases in assessed value, etc.) are remarkably weak, particularly considering the involvement of public funds. In 2009 the Missouri legislature modified TIF and TDD statutes to require better reporting and, in the case of TDDs, a financial penalty for failure to submit annual financial reports. While these are improvements, it is still true that the state agencies that have the responsibility for maintaining reports have inadequate resources to discharge those responsibilities. Further, there is no mechanism to require a private project sponsor to deliver economic outcomes, or to allow the taxpayers to recoup the value of local tax incentives if those outcomes don’t happen (sometimes known as “clawback” requirements). Those accountability provisions apply to certain state subsidies like the Missouri Quality Jobs Act, but are absent for local incentives.

7. Educate the voting public on taxes and how public services are funded. Many citizens lack an understanding of how government is funded and the tradeoffs required to balance budgets. This fact, combined with a growing mistrust of government has led citizens to disengage from the process. Local governments have increasingly turned to using economic development incentives, particularly TIF and special taxing districts, as a mechanism to fund services. They are tools that local governments can use to control an additional revenue stream without a popular vote and avoiding legislative caps on major revenue sources. This is not a sustainable means of financing government. We must instead, educate the public on the true costs of services, the tradeoffs that exist and the options for funding public services.

8. There should be a complete database of public expenditures and outcomes for all publicly supported development projects. Because of the lack of widely available information, elected officials and the public cannot possibly make reasoned decisions about the expenditure of tax dollars to produce economic growth. Without that information, it is not possible to know whether local governments are getting value for those expenditures, and because there is no accountability for outcomes, the public cannot recover those expenditures in the event that outcomes are not achieved. One exception is the city of St. Louis, which has required a “clawback” provision in its redevelopment agreements since 2005.

9. Focusing development incentives on expanding retail sales is a losing economic development strategy for the region. The future of sales taxes as a principal source of revenue for local governments should come into question for several reasons: its inherent volatility; the likelihood of a long-term restructuring of retail trade; increasing level of sales taxes discourages spending and local sales in favor of non-taxed internet sales; and, the motivation this tax source provides to focus scarce tax dollars on incentivizing a type of development that appears to yield very limited regional economic benefit. As local governments come under increasing fiscal stress, the impacts of billions of dollars in forgone revenue will become increasingly apparent.

10. Broad measures of regional economic outcomes strongly suggest that massive tax expenditures to promote development have not resulted in real growth. While there are certainly short-term localized benefits in the use of incentives, regional effects are more elusive. Development incentives have primarily acted to redistribute spending and taxes. While distribution effects might yield broader economic benefits when used to redevelop economically distressed communities, when incentives are used in healthy and prosperous communities the regional effect may be to destabilize the fiscal health of neighboring areas. This conclusion particularly applies to retail development. While there is ample justification for tax expenditures on retail development in underserved areas, overall there seems little economic basis to support public expenditures for private retail development. Despite massive public investment, the number of retail jobs has increased only slightly and, in real dollars, retail sales or per capita spending have not increased in years. Furthermore, the region has seen a shift from goods producing (higher paying jobs) to service producing (typically lower paying) jobs, suggesting that although there are more jobs, they are of lower quality. Household income is lower and increasing more slowly than in most of our peer regions.

11. Set aside old ways of thinking and adopt an agenda for regional fiscal reform. In 2008, the Metropolitan Forum brought together a national panel of experts who studied the St. Louis region, concluding the region needs to adopt new ways of thinking. This research supports the need for a regional solution to the problematic overuse of development incentives and the fiscal crisis in which local governments find themselves. Local governments need support to change and adopt a better strategy for the future. Regional fiscal reform will only be possible through a large-scale collaborative process that cuts across jurisdictional boundaries and is inclusive of all sectors and levels of government.

Read report: An Assessment of the Effectiveness and Fiscal Impacts of the Use of Development Incentives in the St. Louis Region

An Assessment of the Effectiveness and Fiscal Impacts of the Use of Development Incentives in the St. Louis… by nextSTL.com on Scribd

Apr 18

Morgan Ford in TGS May See Three-Story, 26-Unit Mixed-Used Project

Planning and design work is progressing for a mixed-used project on Morgan Ford Road in the city’s Tower Grove South neighborhood. An envisioned project would replace a car wash as Morgan Ford and Connecticut with a three-story, 26-unit apartment building with 6,000sf of street-level retail.

The 0.42-acre site is now owned by George Smith Partners out of Los Angeles. Among the firm’s team is Vice President Kyle Howerton, a St. Louis native and graduate of Saint Louis University. Initial site design is by JEMA.

From JEMA:

JEMA’s design for a mixed-use residential and retail ground-up building located in south St. Louis is moving forward. The project is located on Morganford Road and is aptly named MOFO. The design concept utilizes a series of solid and perforated corten steel panels, iron spot brick, and wood panels creating a proportion and rhythm reminiscent of historical south St. Louis buildings and streetscapes.

{Morganford Road elevation}

{Morganford Road elevation} {Connecticut Road elevation}

{Connecticut Road elevation} {Morganford and Connecticut}

{Morganford and Connecticut}

Existing site:

About Alex Ihnen

Apr 18

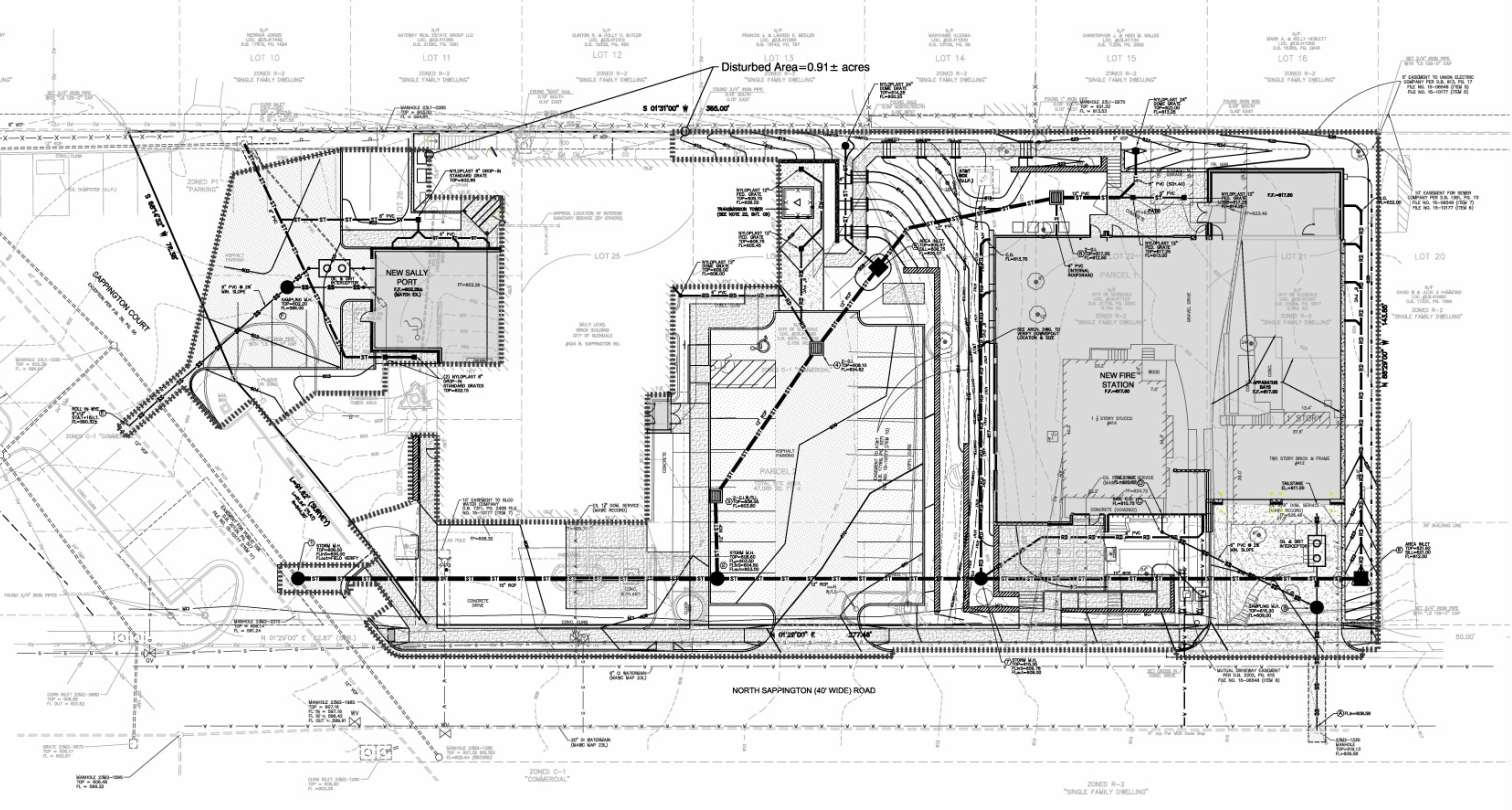

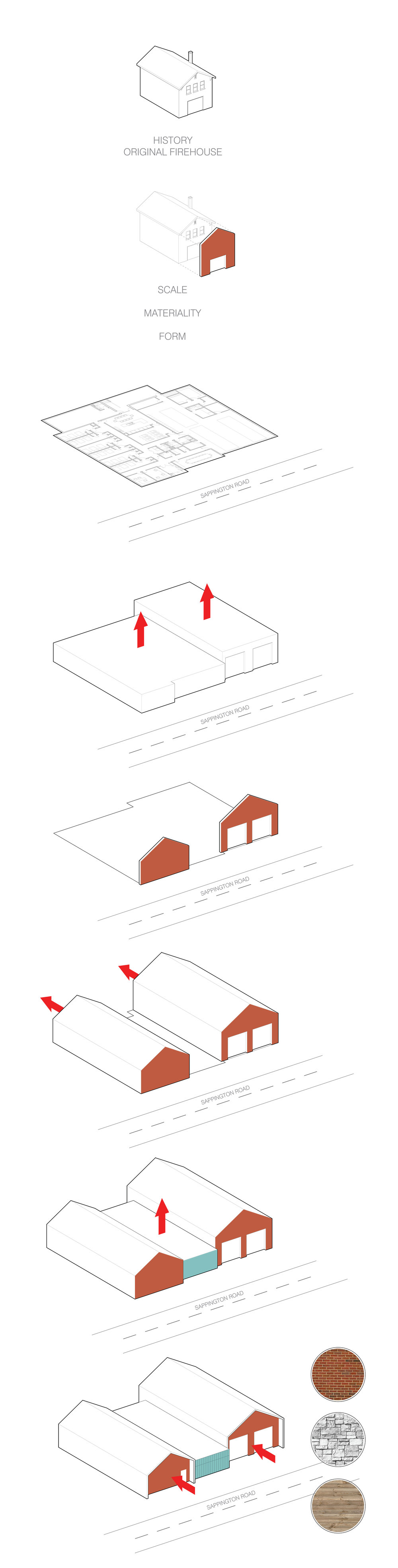

Glendale’s New City Hall, Police HQ, and Fire Station by JEMA Moves Ahead

This past year, residents of the suburb of Glendale, MO approved an $8M bond issue to construct a new Glendale Municipal Center. The project’s $5.2M construction cost is being financed two new taxes, a property tax at 34.6 cents per $100 assessed value, and a new sales tax of .25%, which began this year.

JEMA was awarded the design contract this past fall. The project has now been released for construction bids. Once a builder has been selected, construction should take approximately 18 months. Glendale’s existing municipal building dating from 1915 will be renovated as a new City Hall and Police headquarters. Two homes were demolished to the south to make way for a new fire station.

Glendale, MO is a community of 5,925 residents per the 2010 Census. The town’s population peaked in 1960 at 7,048, declining by 13.6% in the 1970s. Since 1980, the population has declined less than 2%. The mayor of Glendale is Richard J. Magee, who was elected to a sixth term in 2015.

Existing conditions:

The two homes demolished to make way for the new fire station:

Project models and design concept from JEMA:

About Alex Ihnen

Apr 15

Changes Present Better Urban Design for Lafayette Square Praxair Site

When the Pulte Homes and Killeen Studio Architects plan for infill at the long-vacant Praxair site in Lafayette Square hit a road bump a couple weeks ago, we were surprised. Reaction to the very conventional proposal on this site and various social media was almost entirely positive. If you can please this crowd…well, we just thought it would likely sail through.

It turns out that we had switched off our NIMBY radar for maintenance and missed the looming opposition. Residents of Lafayette Square turned out to the city’s Preservation Board meeting, where the Cultural Resources Office was to recommend initial approval, and suddenly the project was stalled. Seems that being against something is still a greater motivator than being for something.

Anyway, Pulte and Killeen apparently listened and returned to the drawing board. The project is scheduled to go back before the Preservation Board later this month. Both the site plan and building design have seen changes.

The new site plan shows Lasalle Street no longer connecting through the development to MacKay Place. A new north-south street enters the development from Chouteau. This allows for an incredibly important change in the orientation of the rowhouses.

In the first site plan iteration, the interior streets were really 26-foot wide alleys, fronting large garage doors and the rear of many townhomes. The front of those residences faced one-another across grass courtyards. The revised plan smartly shows all east-west facing garages fronting 15-foot alleys, with the new 26-foot wide street allowing for every unit to face a street. This arrangement results in the loss of two units, but conforms to neighborhood code, and presents a much more urban form.

There are still shortcomings with the plan, but residents opposed to the development surely see these as features and not bugs. Lasalle should connect through to MacKay. And the alley behind the homes fronting Chouteau should connect to both Missouri and MacKay.

Still, it’s an improvement, and the revised site plan means that this will not be the dominant view within the development:

The second significant improvement is the introduction of several new Historic Model Examples (HMEs). With 62 units, presenting some variation in facades and materials is important in creating an interesting and attractive streetscape.

Revised site plan (April 2017):

March 2017 site plan:

Historic Model Examples (HMEs):

________________________________________

From our previous report: Design and Site Plan for 64 Townhomes at Lafayette Square Praxair Site Presented

Lafayette Square appears close to finally developing the long-vacant Praxair site. Pulte Homes plans to build 64 Killeen Studio Architects-designed townhomes on the Praxair site bounded by Chouteau, Missouri Avenue, MacKay Place and a separate parcel fronting Hickory Street to the south.

The site is within the Lafayette Square local historic district, which stipulates requirements for a new construction project such as is being proposed. The city’s Cultural Resources Office is recommending the Preservation Board grant preliminary approval to the project with several provisions: that rear elevations of buildings within two parcels of public streets be brick; sidewalks be placed on both the north and south sides of the re-opened LaSalle Street; and of course that final plans and materials be reviewed by CRO.

On June 25, 2005 the Praxair site along Chouteau Avenue in the city’s Lafayette Square neighborhood caught fire. The site served as storage for gas tanks, which began to explode, sending debris onto the rooftops of surrounding homes and businesses. In all, as many as 8,000 gas cylinders exploded, and the fire took a full five hours to get under control. Interstate 64, just more than 1/3mi to the north, was closed. The Cardinals game was delayed.

The 4-acre site has sat vacant since. The adjacent Lafayette Walk townhome development stalled after 31 of 37 planned units were completed in 2008. That project was announced in 2004 and suffered from bad timing as units began to sell in late 2007. In recent years, development has picked up in the neighborhood with Mississippi Place on the east side of the park, infill along Park Avenue, and new single-family homes centered on Dolman Street.

Lafayette Walk townhomes adjacent to Praxair site.

Existing Praxair site:

Continue reading: Design and Site Plan for 64 Townhomes at Lafayette Square Praxair Site Presented

Apr 14

Friday Live Chat

It’s back, the Friday Live Chat. You know what to do – just use the comments section below. We’re open…