3 St. Louis Home Loan Options for Homebuyers

Are you looking for a home in the St. Louis area? You’re not alone. Though Downtown St. Louis and St. Louis City proper has seen shrinking demand and fewer home buyers, neighborhoods just outside of city limits have seen increased demand. From Kirkwood to St. Charles, the St. Louis area is a hotbed for new home development and housing options on the market. In West St. Louis County, due to increased demand in properties, housing values have increased significantly and are expected to continue to increase. Homes in Webster Groves, Kirkwood, Ballwin, and Ladue have increased in value and homes don’t remain on the market for long. It’s important to act fast when buying a home in hot neighborhoods, however, acting fast is often limited by scarce monetary resources. Here are three St. Louis mortgage companies options to consider when buying a home.

St. Louis Military Loans

St. Louis Military Loans or VA Loans are available to a wide range of St. Louisans and Missourians who are connected to the US Military. Unfortunately, as the name would suggest, you must have ties to the US Military. Civilians who don’t meet the criteria listed later in this post are not eligible for military or VA loans. To determine eligibility, take a look at the criteria below to see if any of the characteristics fit you or a loved one.

- Active Duty US Military

- Active Reservist Us Military

- US Military Veterans

- Spouses of Active Duty US Military

- Spouses of US Military Veterans

- Spouses of Deceased US Military that haven’t remarried

If you fit one or more of those descriptions, you’re probably eligible for a Military/VA home loan. That’s fantastic as these loans can be very significant. However, Military/VA loans are more restricted than conventional home loans. Here are the following criteria that come with applying for or taking out a Military/VA loan.

- Primary House Only (as compared to primary, secondary, or investment property)

- No Down Payment (as compared to a down payment that varies by creditworthiness and bank)

- Fixed VA/Government fees and monthly premiums (as compared to fees that vary by bank)

- No Insurance Required (as compared to up to 20% of loan amount)

- FICO Score of 620 or Higher (similar to FICO requirement of conventional home loan)

St. Louis Military Loans can sometimes, cover the entire cost of a home. With no down payments, generous loan amounts, generous rates, and low fees, if you’re eligible or believe you could be eligible for a Military/VA loan, apply as soon as possible. These loans are a great way to honor those who are serving or have served their country. With a flourishing military community in St. Louis, these loans are sure to be a popular option.

St. Louis USDA Loans

St. Louis USDA Loans are housing loans offered by the US Department of Agriculture. Again, these loans are restricted to certain applicants and geographical areas. USDA loans were launched to stimulate rural (and occasionally suburban) growth and home ownership. These loans encourage younger individuals and middle-income individuals or families to move to developing rural regions of the country.

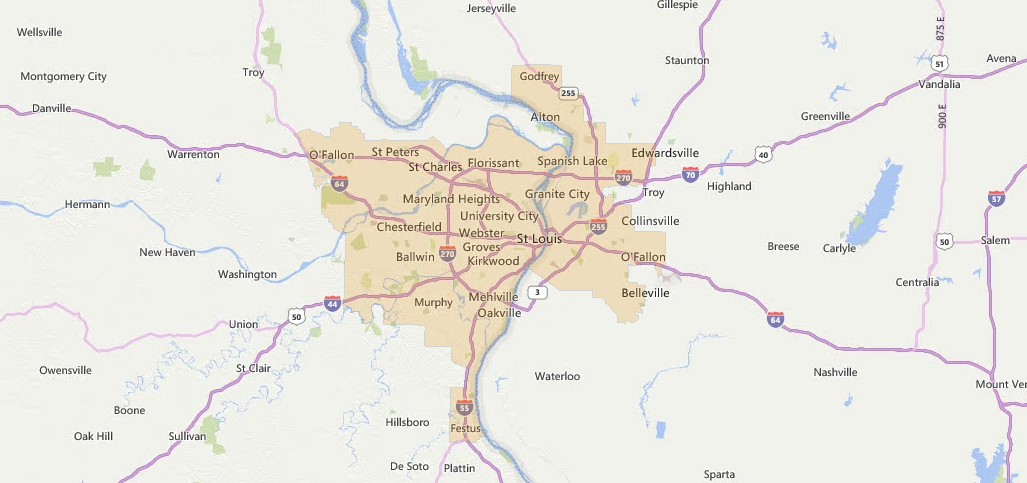

In the St. Louis region, areas including Troy, MO, parts of Edwardsville, IL, Hillsboro, MO, and Pacific, MO, among others, are eligible for USDA loans. The USDA has provided a detailed map outlining eligible and ineligible regions. In addition to the USDA loans being restricted by location, the loan is also income restricted. Again, income eligibility is determined by the area in which you plan to live and of course, income. In some areas, the maximum income is $50,000 a year while others, the maximum income can be as much as $75,000 a year.

(Image: USDA)

Again, the USDA loan has more restrictions than a conventional housing loan. Below are the criteria for a USDA loan and how the loan differs compared to a conventional housing loan.

- Primary House Only (as compared to primary, secondary, or investment property)

- No Down Payment (as compared to a down payment that varies by creditworthiness and bank)

- $100 Fee per $100K Borrowed. monthly premium (as compared to fees that vary by bank)

- Insurance Required, amount varies but can be financed into loan (as compared to up to 20% of the loan amount)

- FICO Score of 640 or Higher (similar to FICO requirement of conventional home loan)

St. Louis USDA loans are very generous, however, highly restricted. If you believe you’re eligible for a USDA home loan, you should apply, however, there will be fees to access and submit the USDA home loan application.

St. Louis Conventional Home Loans

St. Louis conventional home loans are offered by a variety of financial institutions. The amount of money accessible to an individual varies with income, assets, and creditworthiness. If you’ve spent your young adult life building a credit score and have sufficient income, conventional home loans will probably be accessible. Interest rates and fees will, of course, vary by financial institution and one’s creditworthiness.

If you’re considering a conventional home loan, it’s smart to consult a St. Louis mortgage companies broker and explore as many financial institutions as possible.