Understanding Competitive Exness Fees for Trading Success

In today’s fast-paced financial markets, broker fees can significantly impact a trader’s success and profitability. One broker that has been gaining attention for its competitive fee structure is Exness. In this article, we’ll delve into the various fees associated with Exness, discussing spreads, commissions, withdrawal fees, and more, to help you understand why these competitive Exness fees make it a preferred choice for many traders. For more details on trading with Exness, you can check this link: competitive Exness fees http://wlix.s501.xrea.com/1/trading-indices-on-exness-28/

What are Broker Fees?

Broker fees are charges levied by trading platforms for executing trades on behalf of their clients. These fees can vary widely from one broker to another and can include a variety of elements such as spreads, commissions, overnight fees, and withdrawal charges. Understanding these fees is crucial for traders looking to maximize their investment returns.

Overview of Exness

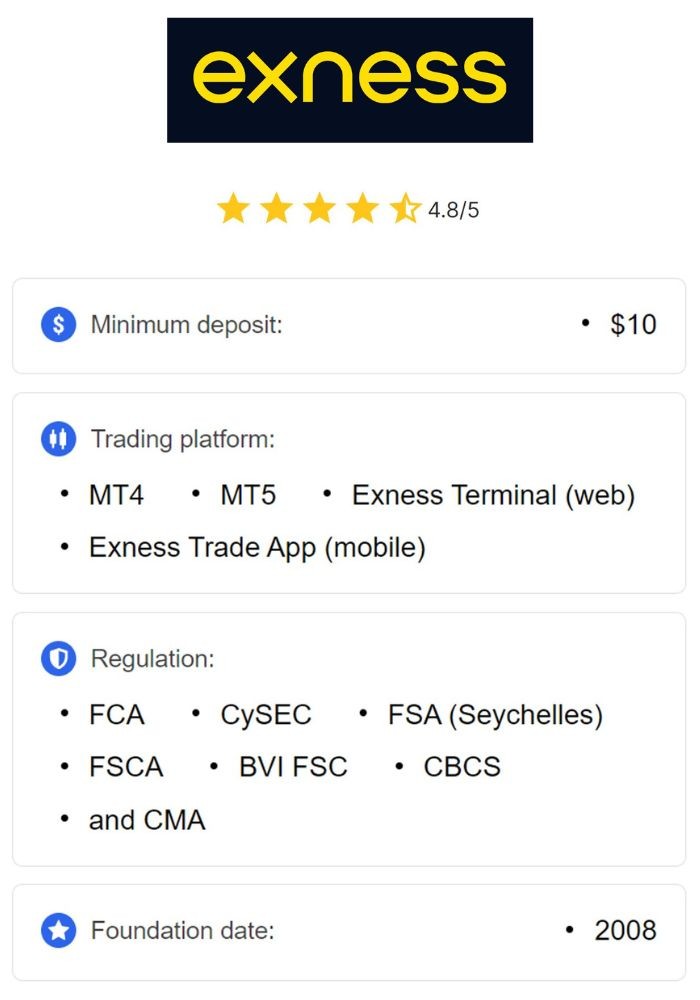

Exness is a well-established online brokerage firm known for its user-friendly platform and extensive range of trading instruments, including Forex, cryptocurrencies, indices, and commodities. It was founded in 2008 and has since grown into a reputable global entity, catering to traders from various backgrounds. One of the key selling points of Exness is its competitive fee structure, which we will explore in detail.

Types of Fees at Exness

1. Spread

The spread is the difference between the bid and ask price of a financial instrument. At Exness, spreads are competitive and vary depending on the account type. For instance, on a Standard account, spreads can start from as low as 0.3 pips, whereas Pro accounts may offer even lower spreads. This means traders can enter and exit trades with reduced costs, which is vital for short-term trading strategies.

2. Commission

While some brokers charge a commission on trades, Exness offers several account types where commissions are either zero or significantly lower than industry averages. For example, the Raw Spread account charges a small commission per trade, but this is balanced out by the much tighter spreads offered, resulting in overall lower trading costs.

3. Overnight Fees

Overnight fees, also known as swap rates, are applicable when trades are held overnight. Exness provides transparent swap rates that can vary based on the currency pairs or assets being traded. Traders have the option to check the swap rates on the platform before executing trades, allowing for strategic planning around overnight positions.

4. Withdrawal and Deposit Fees

Exness stands out by not charging any withdrawal fees for most payment methods. This is a significant advantage for traders who regularly withdraw their profits. Deposit options are also numerous, including bank transfers, credit cards, and e-wallets, with some methods offering instant transactions without any fees. However, it’s essential to check the terms for your specific preferred method, as fees may vary.

Comparing Exness Fees with Other Brokers

When considering a broker, it is imperative to compare their fees with those of competitors. Many popular brokers may charge higher spreads or additional commissions that can eat into your profits. For example, brokers like IG and OANDA are known for their quality of service but often have higher fees, making Exness a more economical choice for both new and experienced traders.

How Competitive Fees Enhance Trading Experience

Lower fees allow traders to maximize their returns, particularly in high-frequency trading scenarios or while utilizing sophisticated trading strategies. Since Exness offers such competitive pricing, it empowers its clients by reducing their overall trading costs, thus enhancing their potential profitability.

Final Thoughts

In conclusion, Exness stands out in the crowded online trading market due to its transparent and competitive fee structure. By offering low spreads, minimal commissions, and no withdrawal fees, Exness caters to the needs of a diverse range of traders. If you’re looking for a broker that prioritizes cost-effectiveness while providing a comprehensive trading experience, Exness is undoubtedly worth considering.

Given today’s trading environment, it is more important than ever to choose a broker that offers both competitive fees and a reliable platform. By doing your research and understanding the fee structures of various brokers, you can position yourself for greater trading success in the long run.