Sale of the former site of Holy Trinity Parish transaction was brokered by Hal Ball and Peter Newton of Hilliker Corp.

St. Louis (April 28, 2022) – Jubilee World Church recently purchased the former church located at 3400 St. Gregory Lane, St. Ann, MO 63074 from the Archdiocese of St. Louis in a sale brokered by Hal Ball and Peter Newton of Hilliker Corporation, and Linda M. Jones, a broker with Linda M. Wash Real Estate.

St. Louis (April 28, 2022) – Jubilee World Church recently purchased the former church located at 3400 St. Gregory Lane, St. Ann, MO 63074 from the Archdiocese of St. Louis in a sale brokered by Hal Ball and Peter Newton of Hilliker Corporation, and Linda M. Jones, a broker with Linda M. Wash Real Estate.

The 3.42-acre site was the former location of Holy Trinity Parish. The property consists of three buildings including a church that will seat 450, rectory, and a 20,000 sq. ft. school. The property was built in the 1950s as the St. Gregory Parish Church and school complex, and was consolidated in the 2000s to become St. Trinity Parish. The Archdiocese closed the school at the beginning of the Pandemic in 2020.

Hilliker Corporation and Linda M. Wash Real Estate have worked together for more than 20 years assisting the Archdiocese with their real estate transactions with more than 30 completed sales.

The Archdiocese was represented by Hal C. Ball, Hilliker Corporation Senior Vice President, Principal, and Peter Newton, Vice President, Sales.

Jubilee World Church was represented by Linda M. Walsh of Linda M. Walsh Real Estate.

Contact:

Ann Marie Mayuga, AMM Communications

314.485.9499, annmarie@ammcommunications.com

About Hilliker Corporation

The Entrepreneur’s choice for commercial real estate services in the St. Louis region. Hilliker guides business owners through their needs at each stage of the business life cycle. Since 1985, Hilliker Corporation has brokered more than 10,000 transactions including sales and leases of industrial, office, institutional, retail and investment properties. To learn more, please call, (314) 781-0001, or visit, Http://hillikercorp.com.

###

St. Louis (February 7, 2022) – Jeffrey Altvater, a broker with Hilliker Corporation, facilitated the recent sale of the commercial property located at 25-35 N. Sarah, St. Louis, MO 63108 to Trash Panda LLC, with the first floor to be used for a new coffee shop and the second floor apartment converted to an office. The coffee shop is notable because it will have an on-site roasting machine.

St. Louis (February 7, 2022) – Jeffrey Altvater, a broker with Hilliker Corporation, facilitated the recent sale of the commercial property located at 25-35 N. Sarah, St. Louis, MO 63108 to Trash Panda LLC, with the first floor to be used for a new coffee shop and the second floor apartment converted to an office. The coffee shop is notable because it will have an on-site roasting machine. Contact:

Contact:

40 South News reports that Richmond Heights is considering a plan to replace the building at Big Bend and Clayton with an urgent care facility.

40 South News reports that Richmond Heights is considering a plan to replace the building at Big Bend and Clayton with an urgent care facility.  {Zillow}

{Zillow} {Zillow}

{Zillow}

The sidewalk is open. Hope trees are coming soon.

The sidewalk is open. Hope trees are coming soon.

Lobby

Lobby The mail room features automated package storage. A recipient will receive a text/email whenever a package arrives.

The mail room features automated package storage. A recipient will receive a text/email whenever a package arrives. There are four study rooms.

There are four study rooms. Lounge

Lounge

Gym

Gym

Video screen.

Video screen.

The pool is 8″ deep.

The pool is 8″ deep.  Kitchen

Kitchen Living room

Living room Bedroom

Bedroom Bathroom

Bathroom Garage

Garage They are in talks with someone on leasing the entire commercial space.

They are in talks with someone on leasing the entire commercial space. Glazed Brick.

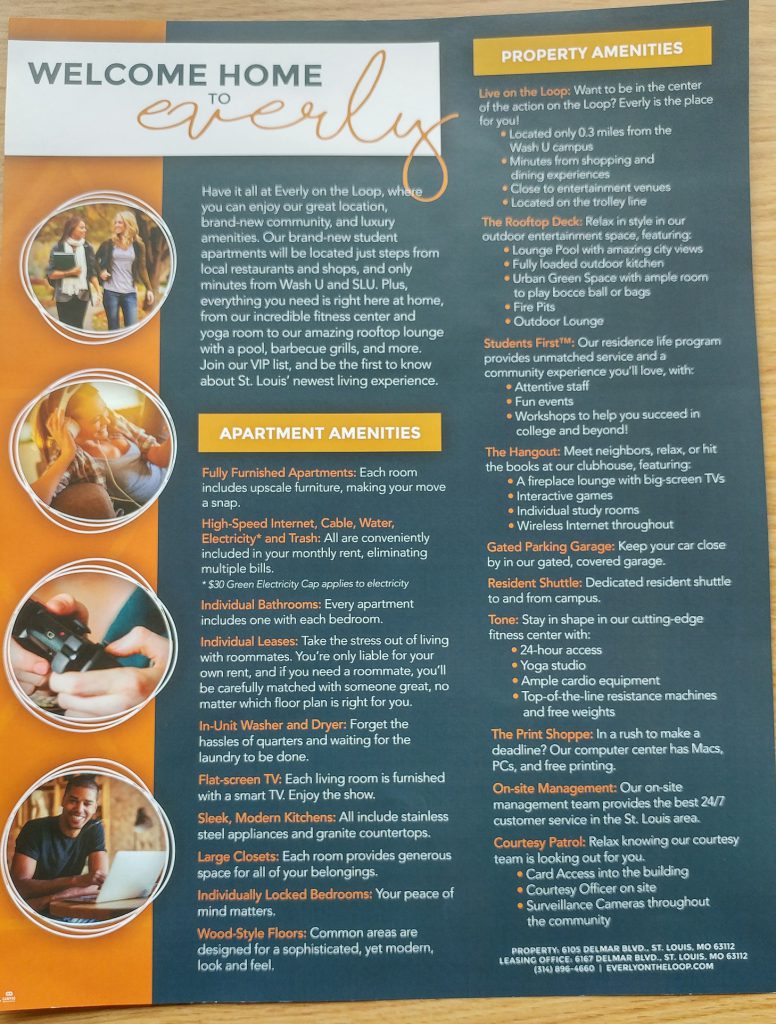

Glazed Brick. Marketing flyer

Marketing flyer

{H3 Studio}

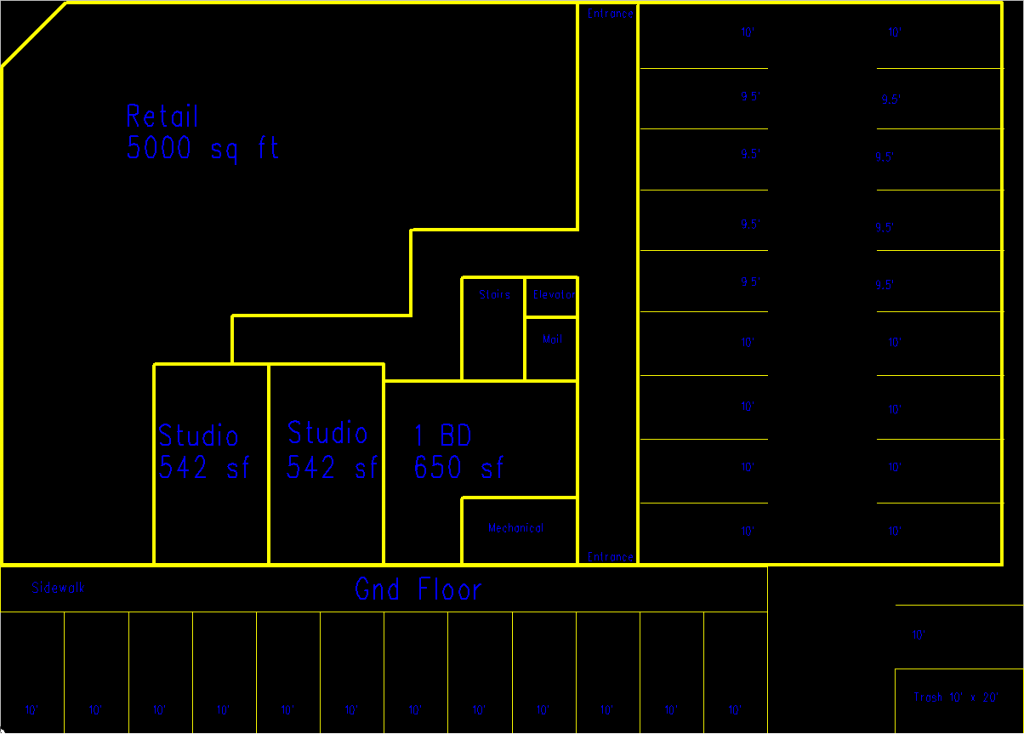

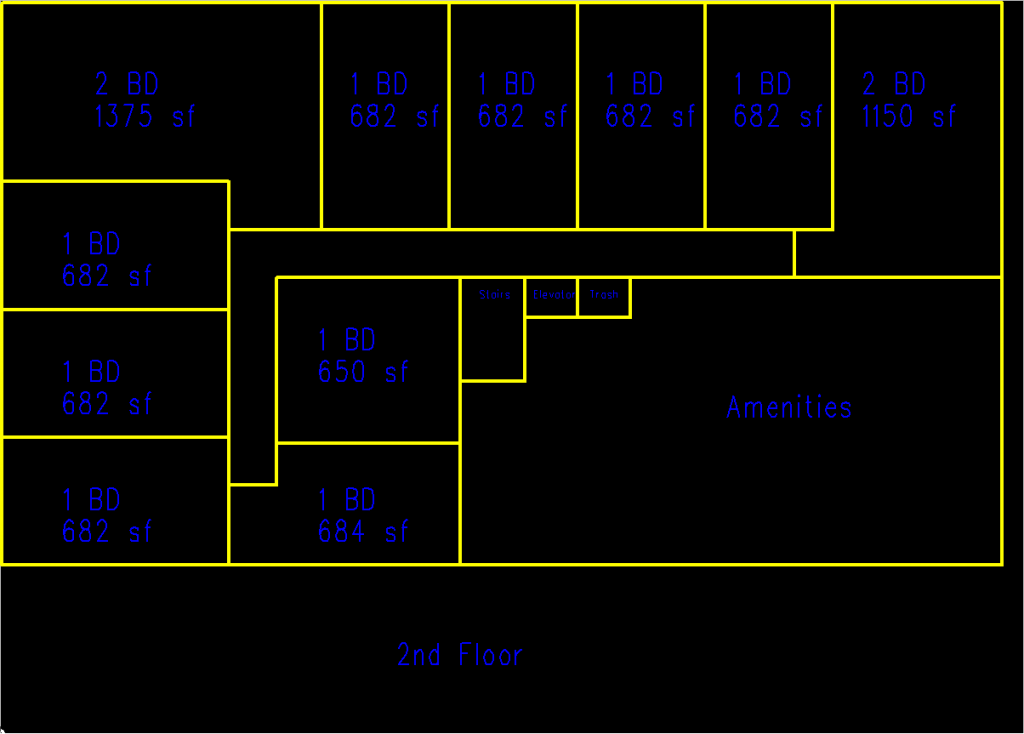

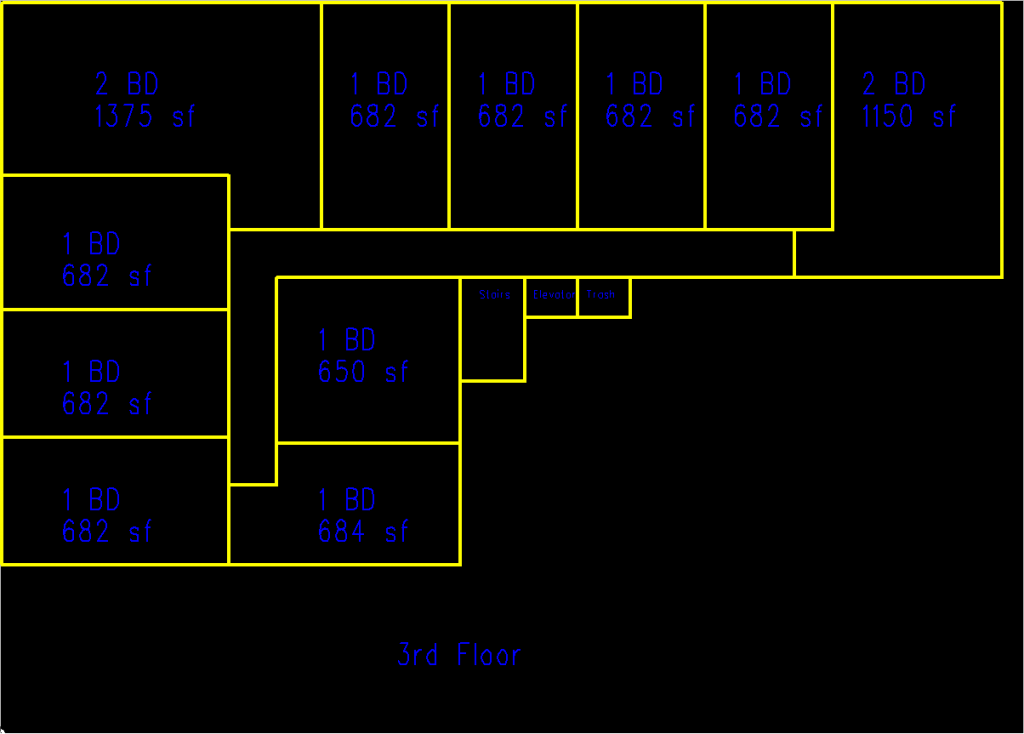

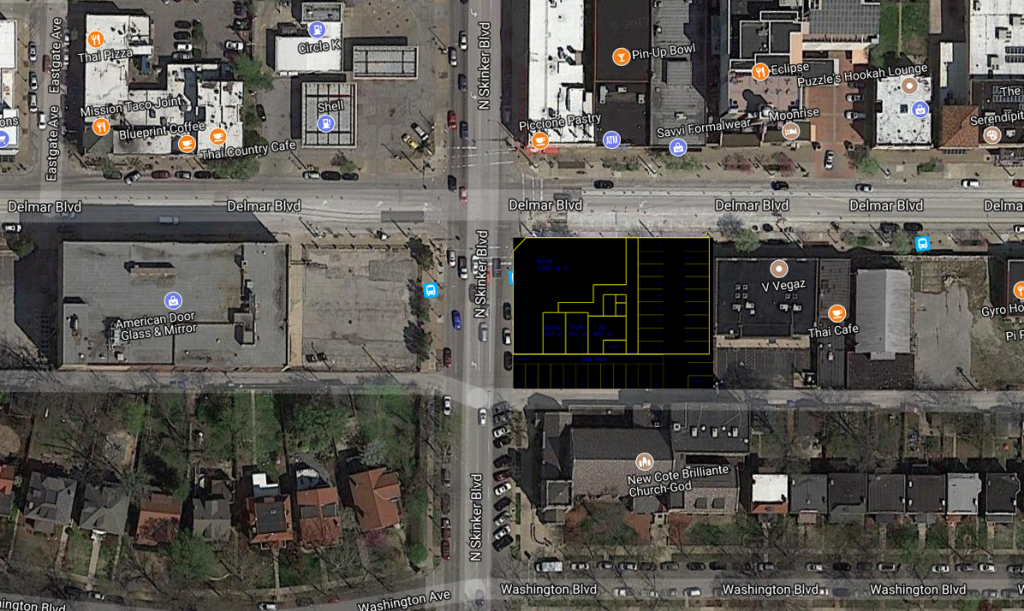

{H3 Studio} {The lot is about as big as 4400 Manchester}

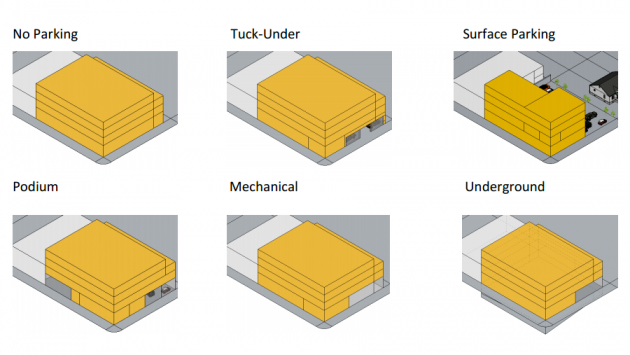

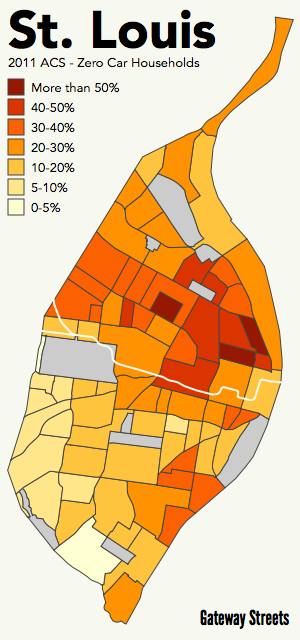

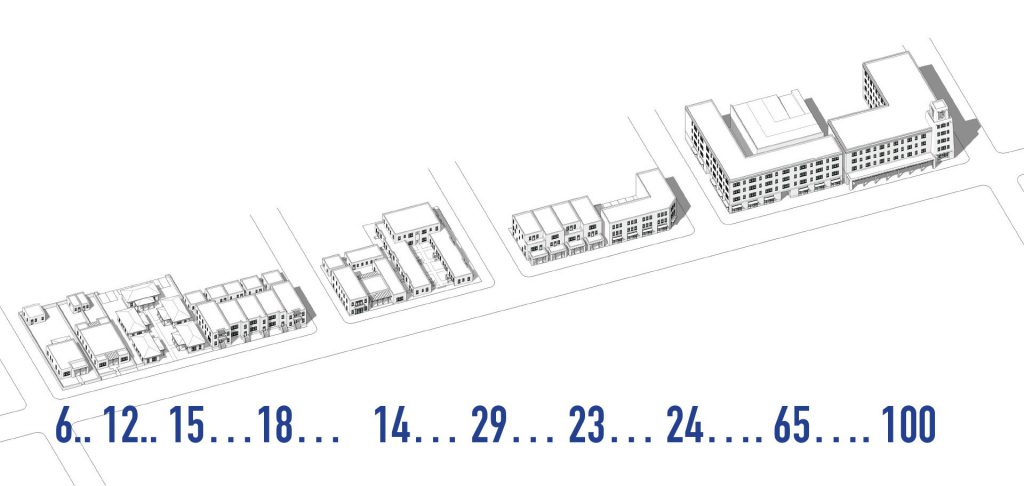

{The lot is about as big as 4400 Manchester} Apartment Blockers – Parking rules raise your rent

Apartment Blockers – Parking rules raise your rent Some parking would be within the building.

Some parking would be within the building.

If we can get over our parking fetish and not take the government-mandated requirements as sacred, we can go taller, making the land more productive, thus increasing further the tax base without increasing tax rates to help make the city solvent. And more people living in the neighborhood means more to patronize local businesses without bringing a car. Four stories- 36 apartments, 0.78 parking spots per dwelling unit. Five stories 47 apartments, 0.53 parking spots per dwelling unit. I wouldn’t go above five so as to not dwarf the New Cote Brilliante Church next door.

If we can get over our parking fetish and not take the government-mandated requirements as sacred, we can go taller, making the land more productive, thus increasing further the tax base without increasing tax rates to help make the city solvent. And more people living in the neighborhood means more to patronize local businesses without bringing a car. Four stories- 36 apartments, 0.78 parking spots per dwelling unit. Five stories 47 apartments, 0.53 parking spots per dwelling unit. I wouldn’t go above five so as to not dwarf the New Cote Brilliante Church next door. {From Greater Central Avenue Albuquerque}

{From Greater Central Avenue Albuquerque}