August 23, 2017 (St. Louis) – AMM Communications LLC, a WBE-certified, St. Louis-based public relations, communications skills training and marketing firm, announced today that it has launched a new executive search division to help clients identify the best talent for their open management positions in sales, business development, marketing, finance, accounting, operations, and administration.

August 23, 2017 (St. Louis) – AMM Communications LLC, a WBE-certified, St. Louis-based public relations, communications skills training and marketing firm, announced today that it has launched a new executive search division to help clients identify the best talent for their open management positions in sales, business development, marketing, finance, accounting, operations, and administration.

Ed Mayuga, a partner at AMM Communications, has nearly 20 years of executive recruitment experience, and he will manage the new division while overseeing the talent acquisition process.

“Since 2008, we’ve helped multiple clients place A-players within their organizations as part of a strategic marketing plan. The demand is there, and it has become increasing difficult to recruit and retain top talent as the US economy has improved,” said Mayuga.

Mayuga uses a proprietary and customized search process that has a successful retention rate of more than 90 percent for new hires after the first year. In addition, what sets the AMM Communications executive search process apart from other search firms, is that the talent acquisition is guaranteed. If for some reason the new hire is not a fit for the position, AMM Communications will reopen the search free-of-charge.

Founded in 2008, AMM Communications LLC, the St. Louis-based strategic marketing communications, public relations, and talent acquisition firm, provides media relations, business development, crisis communications, content marketing, internal communications, communications skills training, digital marketing, reputation management, social media consulting, and executive search services for businesses nationwide. AMM Communications is WBE certified, and has been voted one of the “Best PR Firms in St. Louis” by Small Business Monthly from 2010-2017. We want to help you … Drive your sales. Communicate better. Hire well. For more information, please visit, http://ammcommunications.com or call 314.485.9499.

40 South News reports that Richmond Heights is considering a plan to replace the building at Big Bend and Clayton with an urgent care facility.

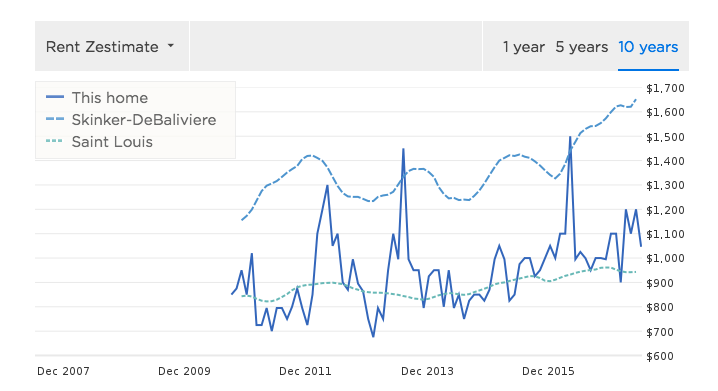

40 South News reports that Richmond Heights is considering a plan to replace the building at Big Bend and Clayton with an urgent care facility.  {Zillow}

{Zillow} {Zillow}

{Zillow}

The sidewalk is open. Hope trees are coming soon.

The sidewalk is open. Hope trees are coming soon.

Lobby

Lobby The mail room features automated package storage. A recipient will receive a text/email whenever a package arrives.

The mail room features automated package storage. A recipient will receive a text/email whenever a package arrives. There are four study rooms.

There are four study rooms. Lounge

Lounge

Gym

Gym

Video screen.

Video screen.

The pool is 8″ deep.

The pool is 8″ deep.  Kitchen

Kitchen Living room

Living room Bedroom

Bedroom Bathroom

Bathroom Garage

Garage They are in talks with someone on leasing the entire commercial space.

They are in talks with someone on leasing the entire commercial space. Glazed Brick.

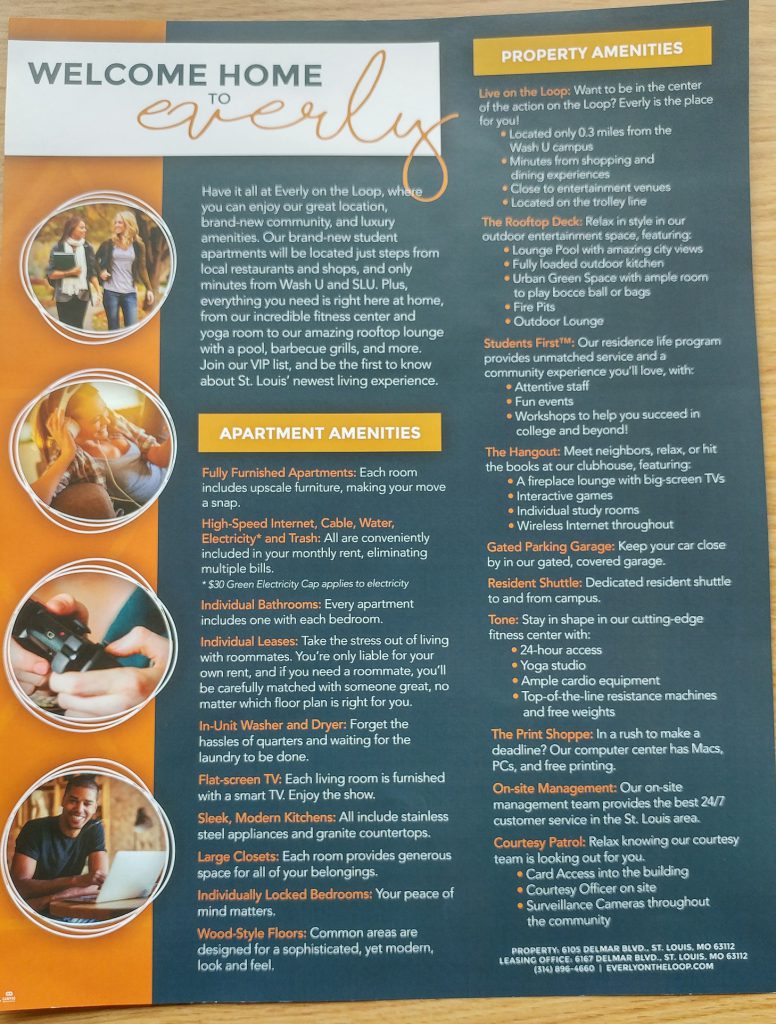

Glazed Brick. Marketing flyer

Marketing flyer August 9, 2017 (St. Louis) – Purk & Associates, the leading St. Louis-based accounting and business consulting firm, was recently named as one of Accounting Today’s “2017 Best Accounting Firms to Work For.”

August 9, 2017 (St. Louis) – Purk & Associates, the leading St. Louis-based accounting and business consulting firm, was recently named as one of Accounting Today’s “2017 Best Accounting Firms to Work For.”